-

Applied Materials Showcases Unique Capabilities to Accelerate Innovation and Drive Long-Term Profitable Growth

Source: Nasdaq GlobeNewswire / 06 Apr 2021 19:15:00 America/New_York

- Outlines strategy to be “the PPACt enablement company”

- Plans to grow revenue by over 55 percent and non-GAAP EPS by more than 100 percent by fiscal 2024

- Commits to return 80 to 100 percent of free cash flow to shareholders

SANTA CLARA, Calif., April 06, 2021 (GLOBE NEWSWIRE) -- At its 2021 Investor Meeting held today, Applied Materials unveiled plans to grow the company’s revenue, earnings and free cash flow by enabling customers to accelerate improvements in chip power, performance, area, cost and time to market (PPACt). Applied also announced plans to generate 70 percent of future services and parts revenue through subscription-like long-term agreements.

Applied outlined five major inflections that are fueling secular growth and the need for innovation as the company drives its longer-term strategy. At a macro level, the digital transformation of the global economy is accelerating. In computing, AI workloads are fueling the need for new architectures based on entirely new types of silicon. Within chipmaking, traditional Moore's Law 2D scaling is slowing, creating the need for a “new playbook” for PPACt that enables continued chip- and system-level improvements. Another inflection is the need to grow the industry in a more sustainable and equitable manner. Finally, customers are seeking not just better products, but also better outcomes, resulting in a business model shift to solutions delivered via subscription models.

“The core of our strategy is to be the PPACt enablement company,” said Gary Dickerson, president and CEO of Applied Materials. “Our broad portfolio and ability to combine technologies in ways no other company can is accelerating value creation for our customers and puts Applied in a leadership position to advance the state of chipmaking for years to come.”

Applied has aligned its strategy to meet the increasingly complex needs of its customers, many of whom participated in the event to discuss trends in computing, semiconductor technology, services and ESG (environmental, social and governance).

Applied summarized the evolution of its Semiconductor Systems business. The portfolio is expanding from unit process equipment that performs a single step to include co-optimized systems with pre-proven combinations along with Integrated Materials Solutions where multiple process technologies are combined under vacuum to create novel materials and chip structures that are not otherwise possible.

“It has been a great journey to walk with Applied Materials over the past 30 some years,” said Dr. Mark Liu, chairman of TSMC. “Beyond 3nm, to sustain the rate of improvement, and I believe we will, we need to work together closer than ever before. We need to innovate in new transistor structures, in new materials, in new system architecture, and in new 3D integration. It is an exciting time. We look forward to working with Applied Materials to discover the future semiconductor innovations.”

The company also presented case studies of Applied AIX (Actionable Insight Accelerator) – a new platform that enables semiconductor engineers to use the power of big data and AI to accelerate the discovery, development and commercial deployment of new chip technologies.

“It’s hard to simply put a number on it, but we all know that improving the process margin is the key to enable technology node migration,” said Seok-Hee Lee, CEO and president of SK hynix. “In many cases, it not only requires the adoption of advanced new technologies in a number of areas including materials, process and equipment, but it also requires all those factors to be optimized for the integration of multiple process steps. Each change in process variables affects others at multiple levels, so accelerating the cycle of learning to come up with the optimal solution is crucial. If Applied Materials develops new process technologies which are already co-optimized with adjacent process steps, it will help reduce development complexity for chipmakers. I think our development activities can move at a fast pace if we work together to harness the power of sensors, big data and AI to map and predict the effect of many process variables.”

As electronic products become smarter the silicon content per device is increasing, including specialty semiconductors based on mature process nodes. Applied is addressing this growing demand with its ICAPS group (IoT, Communications, Automotive, Power and Sensors). The company is now generating more than $3 billion per year in the ICAPS business.

“GF is focused on the largest, most pervasive segments of the semiconductor industry and where technology has the broadest impact,” said Tom Caulfield, CEO of GF. “Our industry began a fundamental shift 15 years ago with the emergence of the smart phone, which brought new features including image sensors, battery management and secure pay. This also led to the Internet of Things that’s now moving from all things connected to all things intelligent. Gary Dickerson and team saw this trend early on and created a group dedicated to innovation on adding features to semiconductor products on all nodes. Today at GF, we leverage much of Applied’s capabilities for the technologies we innovate and manufacture.”

To support the sustainable growth of the semiconductor industry, Applied underscored its ESG commitments with initiatives that are being driven within the company and in collaboration with suppliers, customers and the computing industry.

“Micron is highly committed to reducing our environmental impact,” said Sanjay Mehrotra, president and CEO of Micron. “We appreciate how Applied Materials has embraced similar goals and made strong commitments to increase the eco-efficiency of its manufacturing systems.”

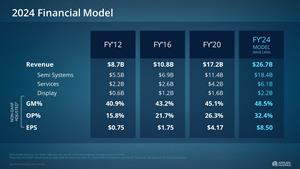

2024 Financial Model

In the base case assumptions of its 2024 financial model, Applied plans to grow revenue by over 55 percent and non-GAAP EPS by more than 100 percent as compared to fiscal 2020. It plans to increase Semiconductor Systems revenue by over 60 percent. The company announced a commitment to return between 80 and 100 percent of free cash flow to shareholders.

Applied plans to grow its services business by over 45 percent as it increasingly moves beyond transactional parts and maintenance to comprehensive services delivered via subscription to give customers better outcomes from lab to fab. Key to the growth strategy is expanding the use of digital services and remote capabilities that use sensors, analytics and AI.

In its Display business, Applied expects to benefit from the next wave of OLED growth as the technology becomes more pervasive in smartphones, notebook PCs, tablets and TVs. Applied plans to increase annual operating margin in its Display business to around $600 million dollars on average over the four years ending 2024.

“The growth momentum in our reporting segments is the foundation of our new target financial model,” said Dan Durn, senior vice president and CFO of Applied Materials. “Combined with our focus on execution, discipline and resulting margin improvements, we plan to drive a high-ROI model that generates strong free cash flow and attractive shareholder returns.”

A replay of the Applied Materials Investor Meeting, along with the presentation and related materials, are available on the company’s website at http://www.appliedmaterials.com/company/investor-relations.

Non-GAAP and Other Financial Measures

Free cash flow is defined as operating cash flow, less net capital expenditures. Reconciliations of non-GAAP to GAAP measures are contained in the 2021 Investor Meeting presentation, which is available on the investor page of the company’s website. The non-GAAP adjusted EPS and gross and operating margin targets assume non-GAAP adjustments as applicable for future periods, which we are unable to predict without unreasonable efforts due to their inherent uncertainty. Management uses non-GAAP adjusted financial measures to evaluate the company's operating and financial performance and for planning purposes. Applied believes these measures enhance investors’ ability to review the company’s business from the same perspective as the company’s management, and facilitate comparisons between periods on a consistent basis. There are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP and may differ from non-GAAP methods of accounting and reporting used by other companies.Forward-Looking Statements

This release contains forward-looking statements, including those regarding anticipated growth and trends in our businesses and markets, industry outlooks and demand drivers, technology transitions, our business and financial performance and market share positions, our capital allocation and cash deployment strategies, our investment and growth strategies, our development of new products and technologies, our business outlook through fiscal 2024, and other statements that are not historical facts. These statements and their underlying assumptions are subject to risks and uncertainties and are not guarantees of future performance. Factors that could cause actual results to differ materially from those expressed or implied by such statements include, without limitation: the level of demand for our products; global economic and industry conditions; the effects of regional or global health epidemics, including the severity and duration of the ongoing COVID-19 pandemic; global trade issues and changes in trade and export license policies, including the recent rules and interpretations promulgated by the U.S. Department of Commerce expanding export license requirements for certain products sold to certain entities in China; consumer demand for electronic products; the demand for semiconductors; customers’ technology and capacity requirements; the introduction of new and innovative technologies, and the timing of technology transitions; our ability to develop, deliver and support new products and technologies; the concentrated nature of our customer base; acquisitions, investments and divestitures; changes in income tax laws; our ability to expand our current markets, increase market share and develop new markets; market acceptance of existing and newly developed products; our ability to obtain and protect intellectual property rights in key technologies; our ability to achieve the objectives of operational and strategic initiatives, align our resources and cost structure with business conditions, and attract, motivate and retain key employees; the variability of operating expenses and results among products and segments, and our ability to accurately forecast future results, market conditions, customer requirements and business needs; our ability to ensure compliance with applicable law, rules and regulations; and other risks and uncertainties described in our SEC filings, including our recent Forms 10-Q and 8-K. All forward-looking statements are based on management’s current estimates, projections and assumptions, and we assume no obligation to update them.About Applied Materials

Applied Materials, Inc. (Nasdaq: AMAT) is the leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world. Our expertise in modifying materials at atomic levels and on an industrial scale enables customers to transform possibilities into reality. At Applied Materials, our innovations make possible the technology shaping the future. Learn more at www.appliedmaterials.com.Contact:

Ricky Gradwohl (editorial/media) 408.235.4676

Michael Sullivan (financial community) 408.986.7977Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/81aef57e-f640-4c78-93d7-e4839b652b0b

https://www.globenewswire.com/NewsRoom/AttachmentNg/d8b4df32-f2f9-44f7-a549-d9d20480a611